Psychology

Some of the ideas I’ve presented so far are certainly different than how most people think about money, but they’re not original.

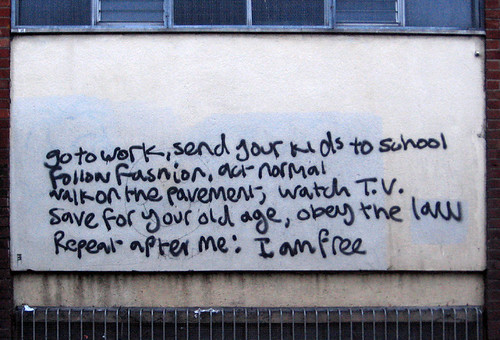

The most important thing about this entire topic is psychology. The trouble that most people have with money is not simple math, it’s how they think about it. Most people - and that certainly includes me - struggle constantly with comparisons and material desires. This is why the identification of wealth as something not exclusively material is so important. Representing wealth as time, health, work, or happiness presents an altogether different, more humble, more realistic, and more joyful perspective on money.

Dave Ramsey

I read Dave Ramsey’s book a little while back with the expressed intent of understanding exactly what I didn’t like about his methods. I knew I didn’t like it, but I wanted to be able to speak more cogently about why.

It turns out that I agree with most of what he says. Ramsey starts with psychology and changing the way people think about money. The Debt Snowball method is the most obvious example. Paying off the smallest debt regardless of interest costs is mathematically incorrect, but it ties directly into transforming the psychology of the debtor. The math doesn’t matter anyway.. extreme circumstances excepting, if you were that good at math, you wouldn’t be in huge debt in the first place!

Dave’s process is generally laudable and he wants badly to help people in bad situations. Starting with changing psychology is the right way to do it, so kudos to him. Still, I worry that he relies too much on the idea of discipline and material wealth. The people he uses as examples in his books all turned things around with massive discipline and all push towards having strong material wealth.

So I want to be very specific about the differences between what I’m trying to say and what Dave Ramsey says. His method is a way to change psychology to drive discipline and build wealth. He focuses on contentment and charity as well, and I’m all for it. The point of difference to me is the definition of wealth. By asking the question of our own goals in the form of time, health, work, and happiness, we get to completely sidestep the question of discipline. The answer to “Why don’t I want to buy that right now?” changes from “it’s not in the budget” or “disciplined spending habits” to “that’s not a part of my goals.” That change, for me at least, is an altogether more powerful force. But then I’ve never had much discipline on spending, or anything else.

No-debt-at-all is another thing I don’t agree with in Dave Ramsey’s worldview. He seems to be against it in any form and insists on paying it off immediately. Instead, I think debt is just another tool. When interest rates are low (money is cheap), it’s reasonable to consider using debt as a tool for wealth. As a rule, if you can’t pay it off right now, then don’t use debt. When you’re just starting out this doesn’t make sense for something like a car, but spreading a mid-size cost out over two or three months on a credit card isn’t unreasonable. Especially if it’s something important like a new lens for your photography hobby. On the corporate side this is called leverage. Companies use debt as a tool even when they have lots of cash in the bank.

Understanding the goals towards which you strive is the most important thing.

Retirement

Retirement is the other huge piece of psychology that is an affront to the idea of wealth.

Some people actually like to make things. For these people, retirement is a misnomer. Retirement is actually the ability to have control over what they make - to do what they want. These people work to get enough money to work on whatever they want.

On the other hand, some people really are just lazy. They like to waste time. Perhaps this is a majority, but from them we get the more classical definition of retirement. You work until you have enough money to do nothing. These sorts of people look forward to retirement so they can “stop working”.

What a crazy perspective that is! Never in my life can I remember wanting to specifically “do nothing”. And yet this is what it seems the majority of people are working towards, whether they want it or not. Why?

The notion of retirement isn’t much older than a few generations, but as the population and life expectancy has grown together, we’ve ended up with a huge percentage of older folks. For many of our parents or grandparents, the way towards retirement was the pension plan. Today’s version is the 401k. The current generation thinks if they put money in their 401k or 403b it will be a magical panacea for their future financial concerns.

This is another reason why the idea of a fixed income is so inefficient. Fixed income is a tradeoff. You give me a certain quantum of work for a long period of time and I’ll give you the perceived benefit of a time in your life when you can do nothing. If that’s your preferred definition of retirement, then you already have the best of all possible worlds: a stable contract to do relatively little and sit around.

If it’s not clear yet: We need a new definition of retirement. So let’s take another stab at it based on the first group of people: the ones who like to make things. Then retirement is the time and opportunity to do good solid work on whatever you want.

What a big difference! Did you catch the subtext when Maslow said “What a man can be, he must be”? To achieve self-actualization, Man must work!

Hopefully that’s not scary. Work is meant to be joyous. Work is NOT necessarily equivalent to “a job”. Consider the notion of work as an integral part of the wealth of your own life rather than simply as a means to acquire money as an intermediary to material wealth.

Staggering.

It means retirement doesn’t start when you’re 65. It means your job is not a dead-end. It reaffirms the belief that some of the most joyful people are those who love their work. Maybe it’s even a part of their job, but it doesn’t have to be.

The hardest thing about retirement then is figuring out what the things are that you want to make or do. Most people don’t ever have time to themselves to figure this out. As a child they’re told what to do and where to be. This continues through high school. Then they have a small bit of freedom in and right after college. Then they get a job, they find their spouses, and start a family. Once again they’re told - in a way - what to do and where to be. Consequently, most people don’t actually know what it is they want to do, or even that they ought to be working towards it. They just think they ought to be working to support their cyclic lifestyle.

If you’re between 18 and 30, listen up: right now is your biggest opportunity to break out of this false construct. Start figuring out what it is you want to do with your life. Go to Italy or Ireland for 6 months if it will help. What do you enjoy and what do you feel called to do? What do you discern in your work? How does your time, your health, your family, and your joy relate to it? If you’re 40 already or 50, or 60, or 70, don’t let that stop you. There are tons of businesses, schools, and charitable services that would love your time. There are tons of people that will love your drawings, the books you want to write, or the chairs and tables you’d love to build them.