So that’s a whirlwind tour of money and motivations. I’ve covered most of my bases, but there’s still some little tidbits and such that are either repetitive or new but wouldn’t really fit anywhere. So this is the PowerPoint part of my series. I’ve talked a bit about how to think about wealth, happiness, work, and how to step out of the normal mode of a fixed-income day job. I’d love to keep talking more about it with anyone and everyone; I know I’ve still got a lot to learn.

Bullet Points:

-

The Joneses are a joke - you’ll be much happier doing what you want rather than what you think other people think you should want.

-

Financial decisions aren’t just about money. In fact they’re best if not about money. Financial decisions are about your family, your time, your health, your work, your happiness.

-

Learn math. Compare savings now vs. savings over time.

-

Plan it out: 2 years, 5 years, 10 years, 20 years.

-

“What a man can be, he must be.”

-

Enjoy your hobbies. Spend time and money on what you love to do.

-

When doing math on expenses, make sure to include everything, even related expenses. Then pad it 10-100% depending on risk.

-

When looking at big purchases like a car or a house, the maximum loan amount given to you by a lender is just that: a maximum. Try to look in the 40-80% of maximum range. They’re happy if you take the maximum because the more they lend you, the more money they make over the life of the loan.

-

A material expense is worth it if it matters to you, not if it matters that someone else will see that you bought it.

-

You can only minimize your expenses so far. Theoretically at least, your income has no limit. Focus where it makes sense.

-

Treat insurance as insurance, not as an investment. Whole life insurance is an atrociously bad idea. Consider medical insurance the same way if you can.

-

Civilization can be defined by the things we don’t have to think about anymore (unattributed paraphrase). Use your time wisely.

-

Be realistic about car payments. They aren’t a necessity if you don’t want them to be.

-

Short term lending sucks, unless you’re the one doing the lending.

-

Stocks are equities - you actually own something with a given value.

-

Bonds are letting someone else borrow your money. You’re doing the lending, but they’re setting the interest rate.

-

A 401k is the pension plan of our generation. It’s not magic and it’s not the only thing you should be doing.

-

Index funds win everytime. Buffet made a Long Bet on this. You can’t beat the market. Walk away from anyone who says you can.

-

If a financial advisor hasn’t signed something that says they operate in your fiduciary interest, they’re selling you something on behalf of someone else.

-

Diversification is more important than just a buzzword: Try to understand what it means.

-

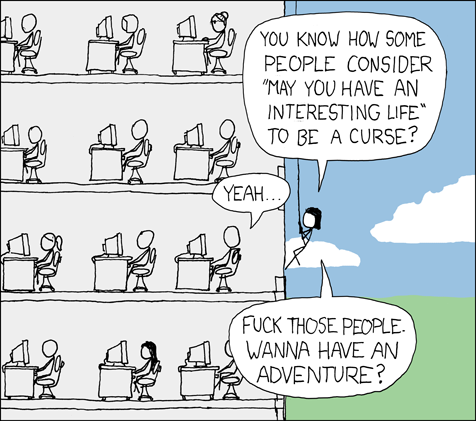

Retirement is not saving enough money to quit the job you hate.

-

Einstein was a patent clerk. He didn’t figure out relativity because he was paid to do it, he figured it out because it was fun. It was hard work, but there was joy in it.

-

Gold goes up in fiat money markets when there’s apprehension. People are looking for something real to own.

-

“My goal with money is to not care about money either way.” -paraphrased